Tax Alert | Strict Compliance or Substantial Compliance for Gift Tax Returns?

February 12, 2024

As the 2023 tax filing season begins, taxpayers who have made gifts in 2023 in excess of $17,000 should be mindful of the requirement to file Form 709 with the IRS. Generally, the IRS then has three years to assess any tax due. However, if no Form 709 is filed or the gift is not adequately disclosed on the Form 709, the IRS has an indefinite time to assess any deficiency.

The regulations state a gift is adequately disclosed when the IRS is apprised of the nature of the gift and the basis for its value. According to the regulations, a gift is “adequately disclosed” when the Form 709 includes:

- A description of the transferred property (including consideration received by the donor);

- The identity of, and relationship between, the donor and each donee;

- If a trust is involved, the trust EIN and either a brief description of the trust terms or the trust agreement;

- Either a copy of any qualified appraisals or a detailed description of the method used to determine the fair market value of the gift; and

- A description of any position that is contrary to the regulations.

The IRS has strictly interpreted the requirements in the regulations. The IRS, by way of example, has argued the failure to provide the full name of the entity being gifted, a missing EIN, and failure to explain the valuation method used.

In Schlapper v. Commissioner, T.C. Memo 2023-65 decided on May 22, 2023, the IRS held that the standard was substantial compliance. The facts in Schlapper are lengthy and involve the gift of a universal variable life insurance policy in the context of the IRS Offshore Voluntary Disclosure Program (OVDP). The taxpayer argued that he had adequately disclosed the gift earlier in the OVDP filings and statements. The IRS argued that the taxpayer failed to satisfy the adequate disclosure requirements in the regulations.

The Tax Court held that while the taxpayer may not have strictly complied with all the requirements in the regulations, he substantially complied by providing sufficient information to apprise the IRS of the nature of the transaction. Therefore, because the taxpayer had adequately disclosed the gifts on his earlier gift tax return, the period of limitation to assess the gift tax started when the return was filed. The IRS was barred from assessing additional gift tax because it issued the notice of deficiency after the bar date; more than three years after the filing plus the agreed-upon one-year extension in Schlapper.

Taxpayers required to obtain appraisals and file gift tax returns should be mindful, that at least with regard to the adequate disclosure requirement for the Form 709, the tax court has adopted the more lenient substantial disclosure standard. In other areas involving charitable contributions, the tax court has applied the more demanding, strict compliance standard.

For More Information or Assistance

David J. Ritter, Esq., Member and Chair, Tax Practice, at dritter@bracheichler.com or 973-403-3117

Robert A. Kosicki, Esq., Counsel, Tax Practice, at rkosicki@bracheichler.com or 973-403-3122

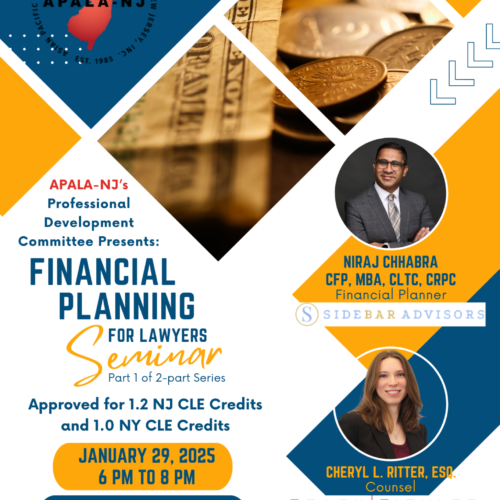

Cheryl L. Ritter, Esq., Counsel, Tax Practice, at critter@bracheichler.com or 973-364-8307